Want More Sales?

More Profits?

More Enjoyment?

Increased sales, improved cash flow,

more enjoyment. Period.

Growing A Business Can Be Hard, Leading And Inspiring A Team Can Be Hard, Staying On Top Of The Constant Changing Economies, Politics And Technologies Can Be Hard....

Don't Do It Alone!

Conference Speaking

If you have a conference, a business exhibition or a sales team gathering and are looking for a 'real' speaker that genuinely connects with and inspires your audience then I am the man for your event.

To ensure that your event is a roaring success, attracting the audience to the event and then motivating them to take action is key to making your event a success. People need connection and they want to relate to the speaker... and as I am always 'from the heart' and 'real' your audience will thank you afterwards.

Coaching & Training

If you want to grow your business or increase your sales and revenue I am your man. I have the 'pedigree' but more importantly I have 'heart'. That means that whilst commerce is important, YOU are much more so. If I can help you I would be honored to do so.

The world has changed but it does not mean there isn't a way to enjoy success. It is possible to blend integrity, ethics, good old fashioned service and still be commercially successful. We do not have to 'cut corners' or use 'clever techniques' or 'hide behind tech'! ...let's adjust and succeed!

'From The Heart' - Always

In my humble opinion our future as a race and the future of business in general means we HAVE to adjust our energy. You are not 'stupid' and no businesses customers are... and so the time has come to step up and serve the customer with heart centered energy.

Let's adjust our approach. Let's 'serve' with integrity. Let's win by doing it right.

Better Selling Skills

Sales improvement Guaranteed when you adjust your approach

It's All About You

Times change, people change - let's 'Evolve' together

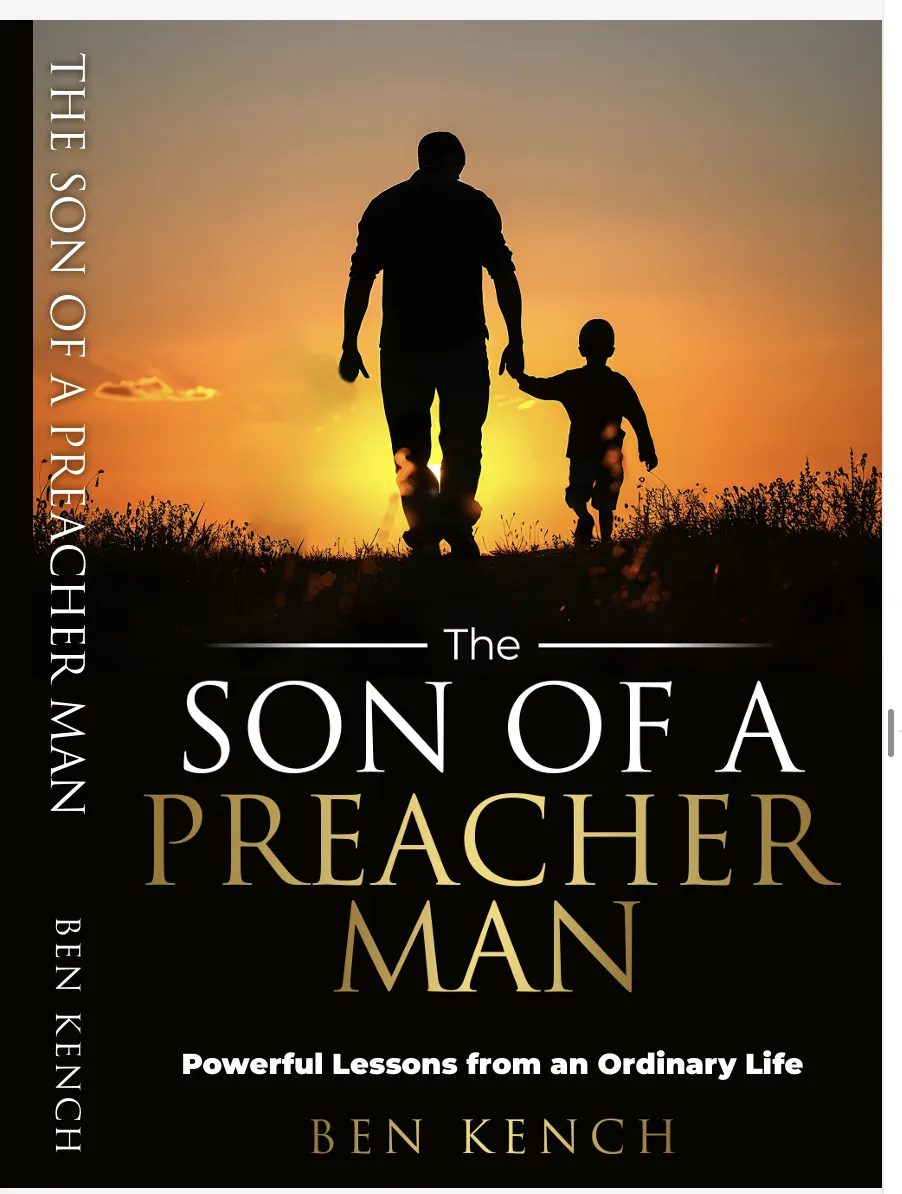

Son Of A Preacher Man

Learn about me and my journey

and the lessons of life

Better Sales Systems

Ai & Automation a 'machine like' approach to the core of the business

In A New Era How

Do You 'Evolve' To Thrive?

Close the gap between where you are and where you want to be with

Ben’s You-Nique 'Evolve' programme.

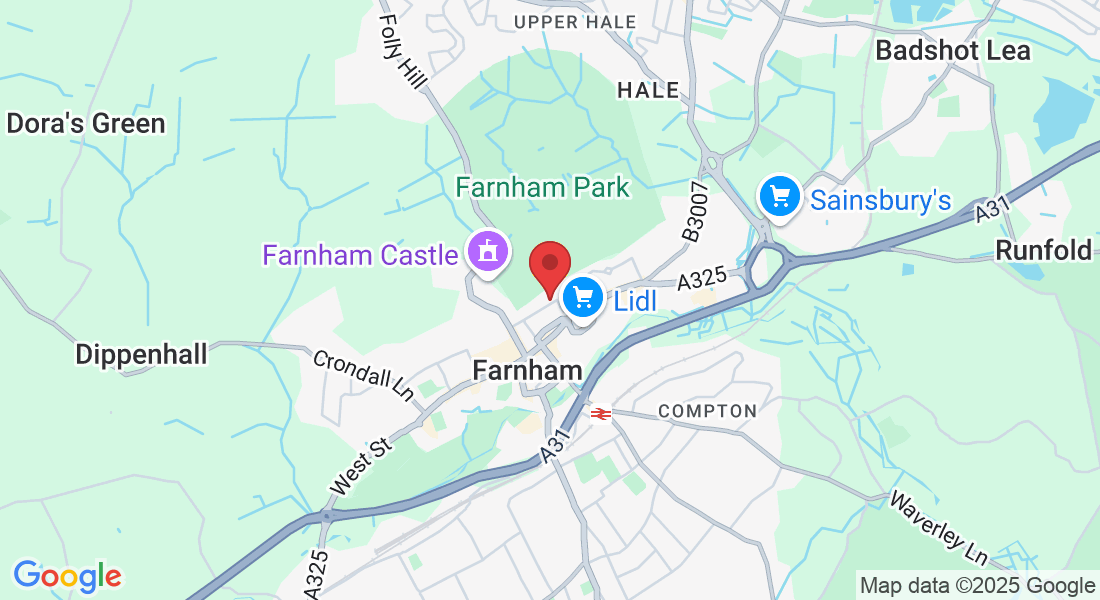

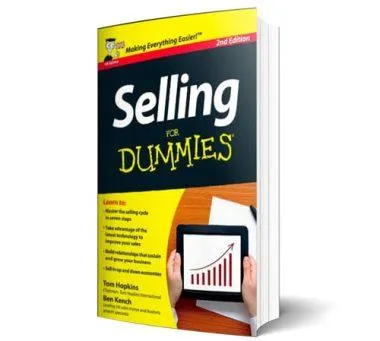

The UK’s No1 Sales & Business Growth Specialist

Ben is the UK’s No1 Sales & Business Growth Coach. As author of “Selling For Dummies” he is widely recognised as an authority on Sales and Sales Systems and he has helped thousands of businesses add literally millions of pounds.

Ben Kench is also a sought-after and accomplished professional speaker known for his insights, energy and entertaining presentations.

If you have a sales team and wish to improve the results Ben can help

The Story Behind The Man

In this profound and raw story Ben shares his past, his troubles and his struggles. Yes, it is at times shocking, at times emotional and at other times heartwarming and insightful but the combination is powerful

Learn from Ben and perhaps it can help you make life a little more 'what you want' instead of 'what you have'.

Why not enrol on 'Evolve' it truly is a life-changing programme.

Don't settle for endless 'not quite right but I can't complain' now is the time to step up and claim the life that you deserve.

Do you have a hunger to increase the quality of your life?

Ben's Business Programs Do Exactly That

'Sales Mastery'

The ‘Sales Mastery’ programme draws on over 30 years of sales learning and specific experience in all selling environments.

Selling has changed. It almost seems like nobody wants to be called 'sales'... and yet ALL businesses need to achieve a sale otherwise it cannot service.

How do you address this so that your business thrives?

How can you make bountiful sales in your sector and not create the 'negative' energy that haas tainted selling previously?

What techniques can be adopted to bring fresh energy and better results to your sales activity?

'Sales Mastery' is truly a 21st Century approach. 'Sales Mastery' is the future not the past. The 'Sales Mastery' programme can revive your company's fortunes.

Franchise Development

Franchised companies are 'sales driven' and often the franchisees need a little extra. This programme boosts franchisee performance.

If you are a franchised business owner then you are familiar with the 'pains' of a growing network. Why is it that, no matter how hard you tune your recruitment, not all of the franchisees on board are as focused and capable?!

Are you feeling frustrated that not all do as directed?

Are you challenged with 'pushing' them when they push back?!

The you-nique franchise development programme works. Positioned as an 'extra support' to assist them it is received by franchisees differently, and obviously with Ben's pedigree the content is curated to drive your goals as a network.

Success Doesn't Happen By Accident! ... But It Can Be Achieved

All around you in the world today there is evidence of people achieving. If there is something 'out there' that you have seen and want for yourself then it absolutely can be yours. This powerful programme could be the start of your journey. When you 'think' like 'success' you can achieve it.

Success Mindset - It Is How You Think That Brings Results

Constant ‘Programming’ Of Your Mind To Help You Get The Success that You Want On ‘Auto-Pilot’!

How You Think Is The Key To Success

A ‘Re-Programming’ is needed!

This carefully selected package of audio and video will help you develop a success mindset... and where your thinking goes your life goes.

Ben's programme is a perfect easy-in and can help you as you set out on the journey of a 'better future'.

Ben equals results

Join 1000's of others who are seeing their lives and businesses change with Ben's help. The simple truth is that you deserve and want 'more' than you have... so come on board and let's work together to genuinely lovingly help you achieve what you seek

Keynote Speaker

If You Have A Conference, A Sales Meeting Or Any Business Gathering Ben's Dynamic Energy

And 'Human' Approach Will Win With Your Audience

It is harder than ever to create and deliver a successful event! Some people have got so used to ‘virtual’ that it’s challenging to get them to be physically present and with so many ‘small and local’ events the choice is bewildering!

How do you get your event to be attractive and worthy of attending? It’s not easy but if you’re planning an event and want a speaker to attract your audience and then deliver a talked-about keynote, just connect.

Leading Your Team, Driving Your Company Vision - It IS Possible... Let Me Be Of Service To Inspire And Motivate Your Team.

Building Bridges to Your Business Dreams.

Keynote Speaker

It is harder than ever to create and deliver a successful event! Some people have got so used to ‘virtual’ that it’s challenging to get them to be physically present and with so many ‘small and local’ events the choice is bewildering!

How do you get your event to be attractive and worthy of attending? It’s not easy but if you’re planning an event and want a speaker to attract your audience and then deliver a talked-about keynote, just connect.

1:1 Executive Coaching Programmes

It is NOT easy running a smaller business! No matter what you try sometimes nothing seems to work!

I am passionate about helping you and easing life's stress...and I have developed a series of 'Programmes' that can genuinely help.

‘From The Heart’ Business Coaching along with 'Sales Mastery' and the incredible 'Your Business Marketing Team' engagement helps you implement new and cutting edge systems and Ai tools to radically bring your business efficiency into the new era.

'Evolve' - A Powerful 'Life-Upgrade'

Life and business almost merge these days don't they?!

If you are a senior person responsible for many in an employed role or actually boldly running your own business, it is difficult to know where the day at work ends and the life at home begins.

'You' are the common denominator. 'You' influence both. 'You' can transform both.

'Evolve' is the incredibly powerful and you-nique programme that can transform your life.

Speaking

Sales Mastery

Franchise Development

'Evolve' Executive Coaching

Driving Growth, Amplifying Impact

Nicky Kay

It was great to attend Ben’s sales training. I loved his approach. Ben is inspiring and left me excited to try his techniques within my business but also hungry to learn more from Ben. It’s a great fresh approach and defiantly the changes needed in this work right now. Highly recommended!

Jeremy Whitakker

I got a great deal from our time yesterday. It was inspiring … to find someone with similar values and outlooks that has actually evolved them into practice….your strengths are in amazing content and delivery…

Thank You Ben

Ross Bates

After spending the morning with Ben and listening to him he reminded me of very important practices when selling.

If you are a seasoned veteran in sales or just starting out, Ben’s message will add value to your approach to sales and people.

Julian Minett

Ben has had a huge impact on our sales results... He has worked with our team and significantly changed our approach and as an outcome our results. Without a doubt I endorse Ben's training if you are seeking sales increase.